Growth in tourism a shining light for Australia

Geoff Bailey and David Smith, Strategic Research and Analysis, Tourism Research Australia

Australian tourism is going through a purple patch. Total visitor expenditure rose strongly last year, up 6.4 per cent to $120 billion, following growth of 7 per cent in 2015.

Consistent with this increase in overall tourism expenditure, Australia’s international tourism sector also grew strongly in 2016. International visiors to Australia reached a record 8 million – up 11 per cent on 2015. This calendar year growth in arrivals was the highest in two decades, a period which included the pinnacle international event, the 2000 Olympic Games in Sydney.

Double digit growth in expenditure for many key markets in 2016

Total trip expenditure by international visitors travelling to Australia increased strongly, up 7 per cent to a record $39 billion last year. Expenditure by Chinese visitors, now Australia’s leading market by value, rose 11 per cent to $9 billion in 2016.

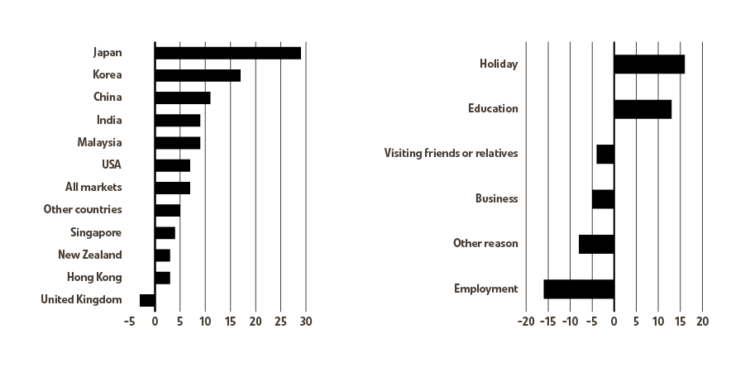

Seven other markets recorded even stronger double-digit growth, including Japan (up 29 per cent) and South Korea (up 17 per cent). Other large markets to perform strongly include India (up 9 per cent), Germany (up 8 per cent) and the United States (up 7 per cent) (Figure 1a).

Holiday sector performing strongly, education not far behind

After a sluggish period in the early part of 2010s, international holiday visitor expenditure has recorded double digit growth in three of the past four calendar years. In 2016, holiday expenditure rose by a record 16.5 per cent to $17 billion (Figure 1b). This growth is underpinned by a 21 per cent increase in the number of international visitors coming to Australia for a holiday.

In addition to the strong growth in the international holiday sector, there was also strong growth in international education travel. The number of education visitors who stayed in Australia for less than one year, rose by 10 per cent in 2016, and their expenditure increased 13 per cent.

Tourism Research Australia survey statistics also show that there is a strong complementary relationship between growth in international tourism to visit friends and relatives and growth in international education for Asian markets. For example, 35 per cent of Indonesian visitors said the main purpose of their trip was for education reasons, but that they had a friend or family member visit them from overseas whilst studying in Australia. Other leading international education markets reporting a high share of visitation by friends or relatives were Malaysia (48 per cent), Singapore (47 per cent), China (22 per cent) and India (14 per cent).

With this high rate of growth occurring across the board, Australian tourism is well on the way to achieving its objective under Tourism 2020 – the National Strategy for Tourism – to increase the overnight domestic and international visitor expenditure to between $115 billion and $140 billion.

With four years to go, this combined expenditure has already reached over $100 billion and is tracking above the lower range of this objective.

We are also punching above our weight internationally. The United Nations World Tourism Organisation indicates that the 14 per cent growth in 2016 in the Australian visitor economy (a grouping that includes longer-staying visitors) was the third highest globally, after India (15 per cent) and Thailand (15 per cent).

The economic impacts of tourism

With domestic tourism performing strongly in recent years, tourism’s contribution to the Australian economy is increasingly important. This manifests itself in different ways:

Tourism’s contribution to gross domestic product is growing:

In 2015-16, tourism gross domestic product increased 7.4 per cent compared to the previous 12 month period – a rate more than triple the growth rate for Australia’s nominal GDP (of 2.3 per cent). As a result its contribution to national GDP continues to increase. In 2015- 16, the direct effects of tourism accounted for a 3.2 per cent share of GDP in 2015-16, up by 0.2 percentage points on 2014-15 estimates.

Total visitor expenditure, Australia, Change – 2016 on 2015, %

Figure 1a: Top 10 markets, other countries and all markets

Figure 1b: Main reason to travel

Tourism accounts for one in 20 jobs in Australia

Tourism is a major employer of Australians:

With 580 200 people in Australia working in the industry in 2015-16. This equates to one in 20 jobs in Australia.

Tourism is gaining an increasing share of exports:

Tourism exports were a strong performer in 2015-16, with the value of exports increasing 11 per cent, while in the same period, the value of Australian exports contracted slightly. This result meant that tourism’s share of Australian exports increased from 9.7 per cent in 2014-15 to 11 per cent in 2015-16.

The economic benefits of tourism are widespread:

Unlike many other industries, which are concentrated in specific geographic areas, tourism provides a source for growth across Australia’s capital cities and regional areas. TRA estimate that 44 per cent of all tourism expenditure in Australia (or in excess of $47 billion) occurred outside Australian capital cities and the Gold Coast in 2016.

Strong growth to continue

The prospects for further strong growth for Australia’s tourism industry is strong. In its latest Forecast publication (released July 2016), TRA forecasts that growth in international visitor arrivals and expenditure will continue, with total visitor expenditure in Australia projected to increase at around 6.8 per cent per year on average over the 10 years to 2024-25.

These forecasts for the tourism export sector are expected to be underpinned by continued solid growth on international air routes servicing Australia, both from international visitors coming here and Australians travelling overseas. Other short-term supportive factors include solid economic growth in Australia’s key markets in Asia, the United States and New Zealand, although growth in Europe will remain more moderate.

In the longer term, the predicted strong growth in Asia’s middle class households is likely to lead to an increasing propensity to travel overseas, including to Australia. A young highly-educated population in emerging Asia, alongside Australia’s current strong reputation as a place to study, should result in an additional boost in the big- spending education market, but also leveraging off this visitation with more friends and relatives coming to Australia to visit these students.

Consumer Insights

To ensure that tourism continues to grow strongly, Australia will need to hold its own in an increasingly competitive global environment. An important element of this is understanding people’s motivations for travel.

Tourism Australia has identified that the key aspects of a destination that influence an individual’s decision to travel to our shores include food and wine, aquatic and coastal experiences, natural beauty and wildlife.

Tourism Australia’s Consumer Demand Project demonstrates that among international consumers from our key tourism markets, Australia has an edge with respect to natural beauty, aquatic and coastal and wildlife experiences.

Insights from the Consumer Demand Project have been used extensively to inform and support development of Tourism Australia’s strategic direction, campaign development, as well as to inform the tourism industry of potential opportunities to build the value of Australian tourism.

More tourism infrastructure investment needed to meet forecast demand

Increased infrastructure will also be essential to support the strongly-growing tourism industry.

TRA estimated as at the end of 2015, pipeline investment in airport infrastructure was estimated at $9 billion. This estimate excludes the recent announcement by the Australian Government to build Sydney’s second airport, the Western Sydney Airport at Badgerys Creek at a cost of around $5 billion.

The accommodation pipeline was making progress in meeting tourist demand but more investment is needed. TRA estimated that projects solely to build tourist accommodation were worth $8 billion in 2015, with this investment to build 15 900 rooms. On top of this investment, TRA estimated that a range of mixed developments which included tourist accommodation is expected to result in an additional 24 000 rooms.

If fully realised, this would increase Australia’s room stock by 16 per cent (or 39 900 more rooms) above the estimated 248 800 rooms in Australia as at December 2015.

Beyond this, more rooms are needed to meet the strong forecast demand for accommodation in Australia with TRA estimating that in 2024-25 international and domestic visitor nights in hotels, motels, guesthouses and serviced apartments will be 36 per cent greater than in 2016.

These growth prospects are creating a positive environment for investment, particularly in Australia’s capital cities. Sydney is an especially good example in this respect, with STR Global statistics showing room revenue increased by 8 per cent in 2016 while occupancy rates remained high at around 85 per cent.